BUSINESS Term Loans

Get Your Business Rolling with Fast Funding When Banks Say No

- Transparent Simple Terms

- No Upfront Fees

- Approvals within minutes

- Funding within hours

By clicking “Get Qualified” & providing your phone number, you agree to receive calls, texts, and SMS messages about business funding options and updates from us. We never sell your information to third parties. You acknowledge that consent is not a requirement to use our services. Message frequency may vary. You can unsubscribe at any time by replying STOP to any message or by contacting us

AWARDS AND recognition

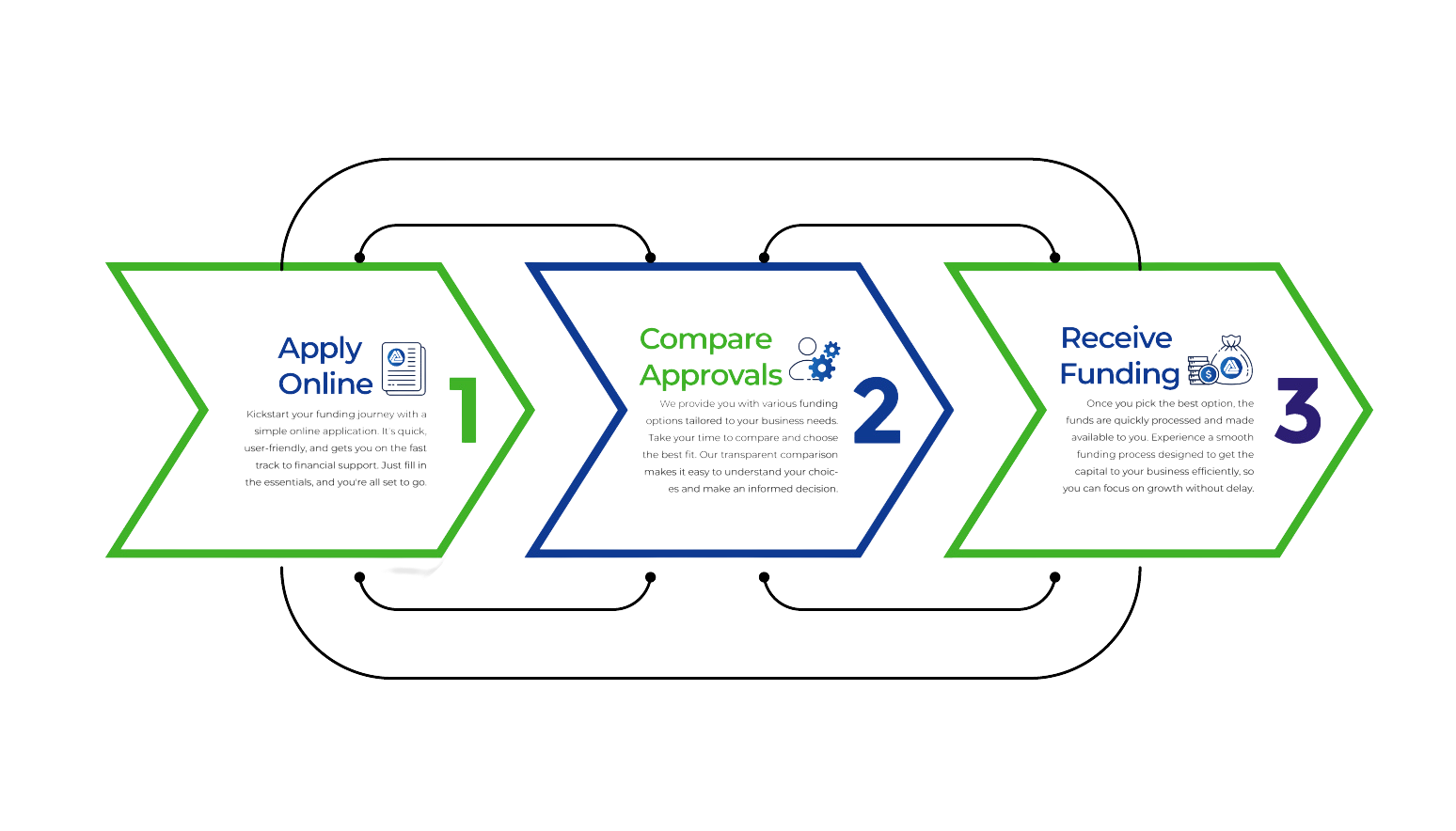

Simplified Steps to Business Funding Capital

FAQ

Business Term Loans

A Business Term Loan is a fixed-sum loan with a specified repayment term. It can benefit your business by providing access to a lump sum of capital that can be used for various purposes, such as expansion, equipment purchase, or working capital. It offers predictable monthly payments, making it easier to manage your finances.

We offer a range of loan terms to suit your business’s needs, typically ranging from one to four years. Repayment options are flexible, including weekly, bi-weekly, monthly installments. Our dedicated team can work with you to customize a term and repayment plan that aligns with your cash flow.

Eligibility for our Business Term Loans is based on factors like your business’s financial health, creditworthiness, and repayment ability. While we consider credit history, it’s not the sole determining factor, and we have flexible eligibility criteria.

No. Our flexible platform is designed to reward you if you do plan to pay off your term loan early.

There are no restrictions on how you can use the funds from a Business Term Loan. You can use the capital to support various aspects of your business, such as expanding operations, purchasing equipment, hiring staff, or managing working capital.

Your Partner in Growth

Loans That Match Your Business Hustle

Need capital to grow, buy new equipment, or handle unexpected costs? It’s challenging when banks don’t understand your situation.

We see beyond the paperwork. Recognizing the urgency of your needs, we’re here with fast, straightforward Business Term Loans. We appreciate the drive and effort you put into your business. That’s why we ensure our process is quick and hassle-free, so you can focus on growth without financial hiccups.

With us, you gain a partner who’s as invested in your success as you are. Let’s tackle those financial hurdles together, ensuring you have the support you need when it counts.

Your Financial Backbone

Short-Term Business Loan

It’s a common roadblock when traditional banking routes seem out of sync with your real-world needs. We understand that behind every application is a story of ambition and perseverance.

With set monthly payments and no prepayment penalties, we offer the kind of flexibility that breathes life into your business plans, whether it’s for managing cash flow, financing new equipment, or covering operational expenses.

Applying for our short-term business loan is worry-free, with no impact on your credit score, and repaying on time can even enhance your business’s creditworthiness. We’re not just lenders, we’re allies in your business journey.

Let’s tackle those financial hurdles together, ensuring you have the support you need when it counts.

Customized Financing For Steady Growth

Growing your business is tough when you’re doing it alone. Secure fixed-rate business term loans that make financial planning straightforward. Ideal for businesses looking for consistent repayments and growth without the unpredictability of changing rates.

Predictable Payment

Enjoy the clarity of fixed monthly payments that fit your budget, ensuring financial management is straightforward. Whether your business journey is just beginning or you’re ready to take the next step, our terms are designed to match your pace.

Expert Financial Support

Connect with our funding specialists who understand your business’s unique needs. We’re here to guide you through the application process, ensuring you find the loan terms that best fit your business scenario, with a focus on growth.

Straightforward Eligibility

Your business’s performance opens the door to financial opportunities. Our simple online application process assesses your needs quickly, allowing you to qualify based on a minimum projected annual revenue of $400,000 and a credit score of at least 550.

Have Questions?

Get Expert Guidance on Business Financing

Need capital to grow, buy new equipment, or cover unexpected expenses?

Our Business Financing Specialists will help you find the best financing options for your business to get you more funding, better terms, and lower interest rates. We’re available to explain every step of the process from applications to your re-payment schedule.